Form W-2 Reporting Requirements

The Affordable Care Act (ACA) requires employers to report the aggregate cost of employer-sponsored group health plan coverage on their employees’ Forms W-2. The purpose of the reporting requirement is to provide information to employees regarding how much their health coverage costs. The reporting does not mean that the cost of the coverage is taxable to employees.

This reporting requirement was originally effective for the 2011 tax year (for the Forms W-2 due by the end of January 2012). However, the IRS made reporting optional for 2011 for all employers. In addition, the IRS made the reporting requirement optional for small employers (those that file fewer than 250 Forms W-2) until further guidance is issued.

Beginning in 2012, the IRS made the reporting requirement mandatory for large employers. Thus, the W-2 reporting requirement is currently mandatory for large employers, but optional for small employers.

Form W-2 Reporting Requirement

ACA Section 9002(a) requires employers to disclose the aggregate cost of applicable employer-sponsored coverage provided to employees on the Form W-2. Section 9002(a) specifically adds this information to the list of other items that must be included on the Form W-2 (such as the individual’s name, social security number, wages, tax deducted, the total amount incurred for dependent care assistance under a dependent care assistance program and the amount contributed to any health savings account (HSA) by the employee or his or her spouse).

The inclusion of this information on the Form W-2 does not change the rules related to taxable income or the tax exclusion for amounts paid for medical care or coverage (which are addressed in another portion of the tax law that is not affected by this change).

This requirement does not require an employer to issue a Form W-2 including the cost of coverage to an individual if it does not otherwise have to issue a Form W-2 for that person. For example, an employer would not have to issue a Form W-2 to a retiree or other former employee receiving no reportable compensation.

Employers Subject to the Reporting Requirement

In general, all employers that provide “applicable employer-sponsored coverage” must comply with the Form W-2 reporting requirement. This includes government entities, churches and religious organizations, but does not include Indian tribal governments or tribally chartered corporations wholly owned by an Indian tribal government.

The Form W-2 reporting requirement is currently optional for small employers (those that had to file fewer than 250 Forms W-2 for the prior calendar year). Thus, if an employer is required to file fewer than 250 Forms W-2 for 2020, the employer would not be subject to the reporting requirement for 2021. Small employers will continue to be exempt from the reporting requirement, unless and until the IRS issues further guidance. Large employers (those that file 250 or more Forms W-2) were required to comply with the reporting requirement starting in 2012.

The Internal Revenue Code’s aggregation rules do not apply in determining whether an employer filed fewer than 250 Forms W-2 for the prior year. Also, if an employer files fewer than 250 Forms W-2 only because it uses an agent to file them, the employer does not qualify for the small employer exemption.

Coverage That Must Be Reported

Under the Form W-2 reporting requirement, the information that must be reported relates to “applicable employer-sponsored coverage.” Applicable employer-sponsored coverage is, with respect to any employee, coverage under any group health plan made available to the employee by the employer which is excludable from the employee’s gross income under Code Section 106.

For purposes of this reporting requirement, it does not matter whether the employer or the employee pays for the coverage—it is the aggregate cost of the coverage that must be reported. The aggregate cost of the coverage is determined using rules similar to those used for determining the applicable premiums for COBRA continuation coverage. It must be determined on a calendar year basis.

- Coverage under a dental or vision plan that is not integrated into a group health plan providing other types of health coverage;

- Coverage under a health reimbursement arrangement (HRA);

- Coverage under a multiemployer plan;

- Coverage for long-term care;

- Coverage under a self-insured group health plan that is not subject to COBRA (such as a church plan);

- Coverage provided by the government primarily for members of the military and their families;

- Excepted benefits, such as accident or disability income insurance, liability insurance or workers’ compensation insurance;

- Coverage for a specific disease or illness, hospital indemnity or other fixed indemnity insurance, provided the coverage is offered as independent, noncoordinated benefits and payment for the benefits is taxable to the employee; and

- Coverage under an employee assistance program (EAP), wellness program or on-site medical clinic if the employer does not charge COBRA beneficiaries a premium for the benefits.

The ACA reporting obligation also does not apply to amounts contributed to an Archer medical savings account (Archer MSA) or to an HSA. Those amounts are already required to be separately accounted for on the Form W-2. Thus, even small employers must report all employer contributions (including an employee’s contributions through a cafeteria plan) to an HSA on Form W-2.

Similarly, salary reduction contributions to a health flexible spending arrangement (health FSA) under a cafeteria plan are not required to be reported. However, if the amount of the health FSA for the plan year (including optional employer flex credits) exceeds the salary reduction elected by the employee for the plan year, the amount of the health FSA minus the salary reduction election must be reported.

In addition, employers may include in the Form W-2 reportable amount the cost of coverage that is not required to be included in the aggregate reportable cost, such as HRA coverage, provided the coverage is applicable employer-sponsored coverage and is calculated under a permissible method.

Example: ABC Company maintains a cafeteria plan that offers permitted taxable benefits (including cash) and qualified nontaxable benefits (including a health FSA). The plan offers a flex credit in the form of a match of each employee’s salary reduction contribution. Sandy makes a $700 salary reduction election for a health FSA. ABC Company provides an additional $700 to the health FSA to match Sandy’s salary reduction election. The amount of the health FSA for Sandy for the plan year is $1,400. The amount of Sandy’s health FSA ($1,400) for the plan year exceeds the salary reduction election ($700) for the plan year. ABC Company must include $700 ($1,400 health FSA amount minus $700 salary reduction) in determining the aggregate reportable cost.

In addition, employers may include in the Form W-2 reportable amount the cost of coverage that is not required to be included in the aggregate reportable cost, such as HRA coverage, provided the coverage is applicable employer-sponsored coverage and is calculated under a permissible method.

Coverage Provided after Termination of Employment

If an employer provides coverage (such as continuation coverage) to an employee who terminates employment during the year, the employer may apply any reasonable method of reporting the cost of coverage for that year, as long as that method is used consistently for all employees. Regardless of the method used, an employer does not have to report any amount for an employee who requests a Form W-2 before the end of the calendar year in which the employee terminated employment.

Example: Bob is an employee of XYZ Company from January 1 through April 25. Bob had individual coverage under XYZ Company’s group health plan through April 30, with a cost of coverage of $350 per month. Bob elected continuation coverage for the six months following termination of employment, covering the period May 1 through Oct. 31, for which he paid $350 per month. XYZ Company will have applied a reasonable method of reporting Bob’s cost of coverage if it uses either of the following methods consistently for all employees who terminate coverage during the year:

• Reports $1,400 as the reportable cost under the plan for the year, covering the four months during which Bob performed services and had coverage as an active employee; or

• Reports $3,500 as the reportable cost under the plan for the year, covering both the monthly periods during which Bob performed services and had coverage as an active employee, and the monthly periods during which Bob had continuation coverage under the plan.

Programs with Non-reportable Benefits

Also, if a program offers benefits that must be reported as well as other benefits that are not subject to reporting, an employer may use any reasonable allocation method to determine the cost of the portion of the program providing a reportable benefit. If the portion of the program that provides a reportable benefit is only incidental in comparison to the portion of the program providing other benefits, the employer is not required to include either portion of the cost on the Form W-2.

Coverage Periods Spanning Calendar Years

If a coverage period, such as the final payroll period of a calendar year, includes December 31 and continues into the next calendar year, the employer has the following options:

- Treat the coverage as provided during the calendar year that includes December 31;

- Treat the coverage as provided during the following calendar year; or

- Allocate the cost of coverage between each of the two calendar years using a reasonable allocation method that is consistently applied to all employees. The allocation method should generally relate to the number of days in the period of coverage that fall within each of the two calendar years.

Penalties

Violations of the ACA’s W-2 reporting requirements are subject to existing rules on filing Forms W-2.

A penalty will apply if the employer:

- Fails to file Form W-2 by the required due date;

- Fails to include all information required to be shown on Form W-2;

- Includes incorrect information on Form W-2;

- Files on paper forms when the employer is required to e-file;

- Reports an incorrect taxpayer identification number (TIN);

- Fails to report a TIN; or

- Fails to file paper Forms W-2 that are machine readable.

An additional penalty may also apply for:

- Failing to provide the Form W-2 by Jan. 31;

- Failing to include all information required to be shown on the Form W-2; or

- Including incorrect information on the Form W-2.

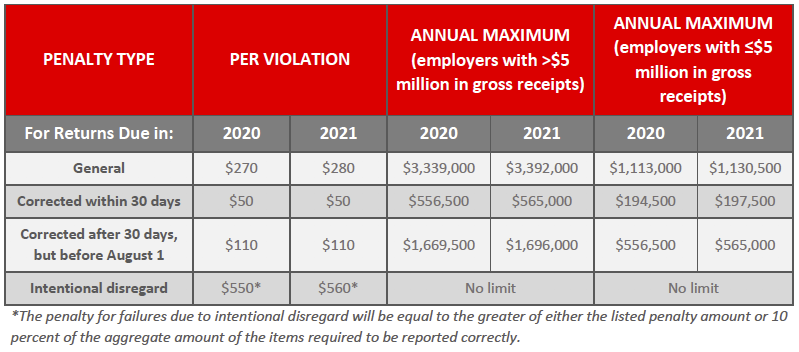

The amount of the penalty is based on when the employer files the correct Form W-2. In 2015, the Trade Preferences Extension Act of 2015 increased the base penalties for failure to file correct information returns or provide individual statements under Code Sections 6721 or 6722. These penalty amounts are indexed to increase with inflation.

The penalty amounts for 2020 and 2021 are as follows:

Exceptions

An inconsequential error or omission is not considered a violation. An inconsequential error or omission does not prevent or hinder the IRS from processing the Form W-2, from correlating the information required to be shown on the form with the information shown on the payee’s tax return or from otherwise putting the form to its intended use. Errors and omissions that are never inconsequential are those relating to a TIN, a payee’s surname, a significant item in a payee’s address, any money or dollar amounts and whether the appropriate form was used.

A penalty will not apply if the employer can show that the failure was due to reasonable cause and not to willful neglect. In general, the employer must be able to show that:

- The failure was due to an event beyond the employer’s control or due to significant mitigating factors; and

- The employer acted in a responsible manner and took steps to avoid the failure.

Even if an employer cannot show reasonable cause, under the de minimis rule for corrections, the penalty will not apply to a certain number of returns if the employer: - Filed those Forms W-2 on or before the required filing date;

- Either failed to include all of the information required on the form or included incorrect information; and

- Filed corrections of these forms by Aug. 1.

If an employer meets all of the de minimis rule conditions, the penalty for filing incorrect Forms W-2 will not apply to the greater of 10 Forms W-2 or one-half of 1 percent of the total number of Forms W-2 that the employer is required to file for the calendar year.

Compliance Steps for Employers

Employers that file 250 or more Forms W-2 should ensure that they are in compliance with the W-2 reporting requirement. They should make sure that they can identify the applicable employer-sponsored coverage that is provided to each employee and calculate the aggregate cost of that coverage.

Employers may also have to address questions from employees regarding whether their health benefits are taxable under this reporting requirement. They can assure employees that this reporting is for informational purposes only, to show employees the value of their health care benefits so they can be more informed consumers. The amount reported does not affect tax liability, as the value of the employer contribution to health coverage continues to be excludible from an employee’s income, and is not taxable.

This Bulletin is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice. Design ©2020 Zywave, Inc. All rights reserved.

Summary

- ACA Section 9002(a) requires

employers to disclose the

aggregate cost of applicable

employer sponsored coverage

provided to employees on the

Form W 2. - This requirement does not change

the requirements with respect to

taxable income or the tax

exclusion for amounts paid for

medical care or coverage. - An employer is not required to

issue a Form W 2 including the

aggregate cost of coverage to an

individual if it does not otherwise

have to issue a Form W 2 for that

person.

LINKS AND RESOURCES

- IRS Notice 2011-28 provides interim guidance on the Form W-2 reporting requirement.

- IRS Notice 2012-9 provides technical reporting information for employers that include health coverage cost information on Forms W- 2 for 2012 and later years.

- Additional Q&As on this requirement are available on IRS.gov.

Beginning in 2012, the IRS made the reporting requirement mandatory for large employers. Thus, the W-2 reporting requirement is currently mandatory for large employers, but optional for small employers.

NEWSLETTER

To receive more HR articles and tips that keep you informed, sign up for our newsletter.