Medicare Part D: Creditable Coverage Disclosure Notices Due Before Oct. 15

Employers with group health plans that provide prescription drug coverage must notify Medicare Part D eligible individuals before Oct. 15 of each year about whether the drug coverage is at least as good as the Medicare Part D coverage (in other words, whether their prescription drug coverage is “creditable”).

his notice is important because Medicare beneficiaries who are not covered by creditable prescription drug coverage and who choose not to enroll in Medicare Part D before the end of their initial enrollment period will likely pay higher premiums if they enroll in Medicare Part D at a later date. Thus, although there are no specific penalties associated with this notice requirement, failing to provide the notice may trigger adverse employee relations issues.

The Centers for Medicare and Medicaid Services (CMS) has provided model notices for employers to use.

Links and Resources

CMS has provided two model notices for employers to use:

- A Model Creditable Coverage Disclosure Notice for when the health plan’s prescription drug coverage is creditable

- A Model Non-creditable Coverage Disclosure Notice for when the health plan’s prescription drug coverage is not creditable

These model notices are also available in Spanish on the CMS website.

Disclosure Notices

Medicare-eligible Individuals

Disclosure notices must be provided to all Part D eligible individuals who are covered under or who apply for the plan’s prescription drug coverage, regardless of whether the prescription drug coverage is primary or secondary to Medicare Part D. The disclosure notice requirement applies to Medicare beneficiaries who are active or retired employees, disabled or on COBRA, as well as Medicare beneficiaries who are covered as a spouse or dependent.

An individual is eligible for Medicare Part D if they:

- Are entitled to Medicare Part A and/or enrolled in Part B as of the effective date of coverage under the Part D plan; and

- Reside in the service area of a prescription drug plan or Medicare Advantage plan that provides prescription drug coverage.

To simplify plan administration, plan sponsors often decide to provide the disclosure notice to all plan participants.

Deadlines

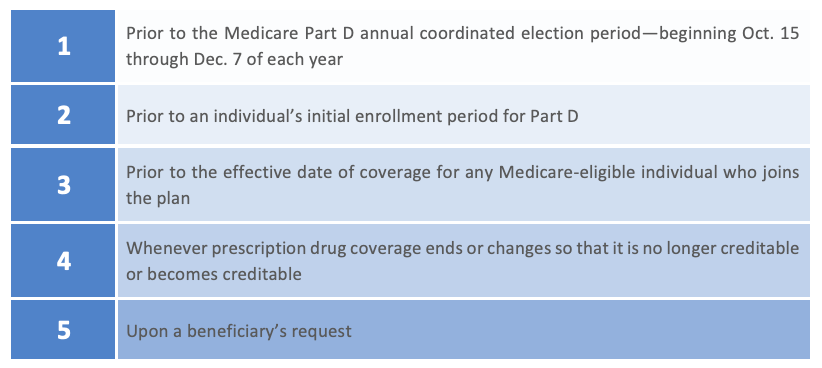

At a minimum, disclosure notices must be provided at the following times:

If the creditable coverage disclosure notice is provided to all plan participants annually, before Oct. 15 of each year, items (1) and (2) above will be satisfied. “Prior to,” as used above, means the individual must have been provided with the notice within the past 12 months. In addition to providing the notice each year before Oct. 15, plan sponsors should consider including the notice in plan enrollment materials provided to new hires.

Distributing Notices

Plan sponsors have flexibility in the form and manner of their disclosure notices. Disclosure notices do not need to be sent in a separate mailing. Disclosure notices may be sent with other plan participant information materials, for example, enrollment and/or renewal materials. If a disclosure notice is incorporated with other participant information, it must meet specific requirements for being prominent and conspicuous within the materials.

As a general rule, a single disclosure notice may be provided to the covered Medicare beneficiary and all of their Medicare eligible dependent(s) covered under the same plan. However, if it is known that any spouse or dependent that is Medicare eligible lives at a different address than where the participant materials were mailed, a separate notice must be provided to the Medicare eligible spouse or dependent residing at a different address.

Disclosure notices may be provided through electronic means only if the plan sponsor follows the requirements set forth in Department of Labor regulations addressing electronic delivery.

Model Notices

CMS has provided two model notices for employers to use:

These model notices are also available in Spanish on the CMS website.

Employers are not required to use the model notices from CMS. However, if the model language is not used, a plan sponsor’s notices must include certain information, including a disclosure about whether the plan’s coverage is creditable and explanations of the meaning of creditable coverage and why creditable coverage is important.

Creditable Coverage

A group health plan’s prescription drug coverage is considered creditable if its actuarial value equals or exceeds the actuarial value of standard Medicare Part D prescription drug coverage. In general, this actuarial determination measures whether the expected amount of paid claims under the group health plan’s prescription drug coverage is at least as much as the expected amount of paid claims under the Medicare Part D prescription drug benefit.

The determination of creditable coverage does not require an attestation by a qualified actuary, except when the plan sponsor is electing the retiree drug subsidy for the group health plan. However, employers may want to consult with an actuary to make sure that their determinations are accurate.

For plans that have multiple benefit options (for example, PPO, HDHP and HMO), the creditable coverage test must be applied separately for each benefit option.

There are currently two permissible methods to determine whether coverage is creditable for purposes of Medicare Part D—a simplified determination method and an actuarial determination method. However, CMS intends to reevaluate the existing simplified determination methodology, or establish a revised one, for calendar year 2026 in future guidance. CMS will continue to permit the use of the simplified determination methodology, without modification, for calendar year 2025 for group health plan sponsors who are not applying for the Retiree Drug Subsidy. More information is available in CMS’ Final Calendar Year 2025 Part D Redesign Program Instructions.

Simplified Determination

If a plan sponsor is not applying for the Retiree Drug Subsidy, the sponsor may be eligible to use a simplified determination that its prescription drug coverage is creditable. The standards for the simplified determination, which are described below, vary based on whether the employer’s prescription drug coverage is “integrated” with other types of benefits (such as medical benefits).

A prescription drug plan is deemed to be creditable if it:

- Provides coverage for brand-name and generic prescriptions;

- Provides reasonable access to retail providers;

- Is designed to pay, on average, at least 60 percent of participants’ prescription drug expenses; and

- Satisfies at least one of the following*:

- The prescription drug coverage has no annual benefit maximum or a maximum annual benefit payable by the plan of at least $25,000;

- The prescription drug coverage has an actuarial expectation that the amount payable by the plan will be at least $2,000 annually per Medicare-eligible individual; or

- For entities that have integrated health coverage, the integrated health plan has no more than a $250 deductible per year, has no annual benefit maximum or a maximum annual benefit payable by the plan of at least $25,000 and has no less than a $1 million lifetime combined benefit maximum.

*The Affordable Care Act (ACA) prohibits health plans from imposing lifetime and annual limits on the dollar value of essential health benefits.

An integrated plan is a plan where the prescription drug benefit is combined with other coverage offered by the entity (for example, medical, dental or vision) and the plan has all of the following plan provisions:

- A combined plan year deductible for all benefits under the plan;

- A combined annual benefit maximum for all benefits under the plan; and

- A combined lifetime benefit maximum for all benefits under the plan.

A prescription drug plan that meets the above parameters is considered an integrated plan for the purpose of using the simplified method and would have to meet Steps 1, 2, 3 and 4(c) of the simplified method. If it does not meet all of the criteria, then it is not considered to be an integrated plan and would have to meet Steps 1, 2, 3 and either 4(a) or 4(b).

Actuarial Determination

If a plan sponsor cannot use the simplified determination method to determine the creditable coverage status of the prescription drug coverage offered to Medicare-eligible individuals, then the sponsor must make an actuarial determination annually of whether the expected amount of paid claims under the entity’s prescription drug coverage is at least as much as the expected amount of paid claims under the standard Medicare prescription drug benefit. This determination involves the same standard as the first prong of the “gross value” test for the Retiree Drug Subsidy.

CMS guidance addresses the extent to which account-based arrangements, such as health reimbursement arrangements (HRAs), may be considered in the creditable coverage determination. In general, this guidance provides that the HRA annual contribution may be taken into consideration when determining creditable coverage status. Existing funds in the HRA that have rolled over from prior years are not taken into account. Also, for HRAs that pay both prescription drugs and other medical costs, a portion of the year’s contribution should be reasonably allocated to prescription drugs.